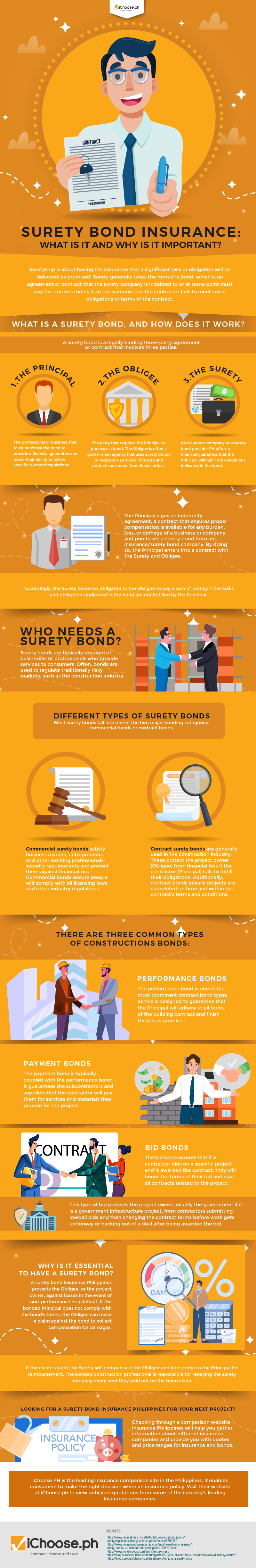

The surety bond is a legal agreement that obligates the insured party to reimburse to another party any legal fees or losses incurred due to the underwriting process of a mortgage, the processing of a title insurance policy, or other similar transactions. While it is not absolutely necessary that all transactions must be performed under the surety bond, the fact remains that most transactions will be. As such, it is very important to understand the why’s and the how’s of the surety bond process in order to be fully informed about the necessary underwriting processes and procedures.

First, why is the need for a surety bond. Surety bonds are designed to protect lenders from unexpected acts of nature (i.e., fraud). While this is true, the fact remains that a surety bond is also designed to protect the lender and his/her investment. While some might argue that the lender should not have to be protected by a bailment contract (in the form of a surety bond), most legal experts agree that penal bonds are still required under many statutes and state law jurisdictions. For instance, many penal bonds are often required for the preparation of an open register mortgage application. Without the protection provided by penal bonds, a lender might be forced to perform the entire transaction under the supervision of a bankruptcy court, which could result in a loss of large amounts of investment capital.

Second, how important to understanding the two-step process of surety bonds. The first step of the two-step process is to obtain the appropriate legal forms from the appropriate source. While it is generally not required, it is strongly advised to always verify the sources of such forms and to always verify their content. In addition, always verify the names of the signatories on the forms and verify that they are all who they claim to be. If not, a borrower could find himself subjected to harsh and potentially expensive penalties under the provisions of the contract. Be sure to conduct extensive research and review the various forms before selecting a surety bond company.

For surety bond insurance philippines or surety bond provider ph, contact iChoose.